In this article,we are going to discuss about Upper and lower circuit in stock market.There are so many issue which new trader faces while trading like:

- Why is my order showing pending in order status when I have placed market order?,

- Why was my order rejected when I place limit order citing reason “rejected due to Price freeze”?,

- Why did Trading haltin the particular stock?

- And many more questions

So this article help you to find the answer to your question.

What is Circuit Filter?

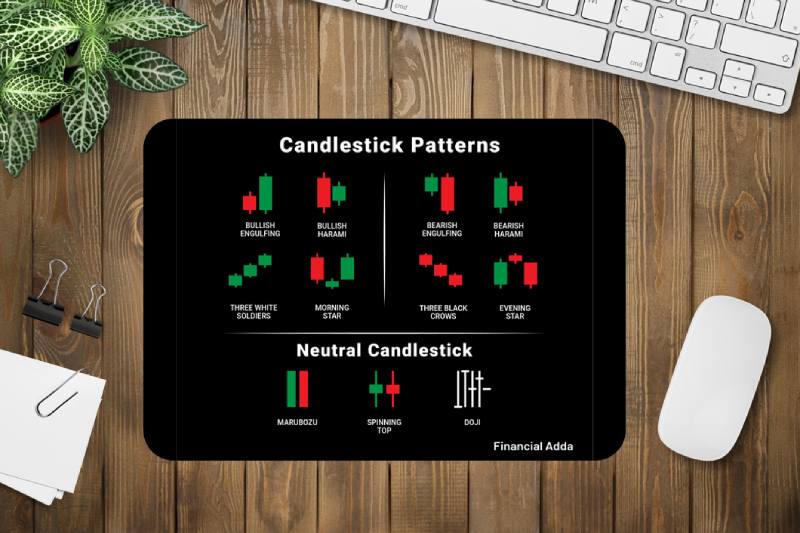

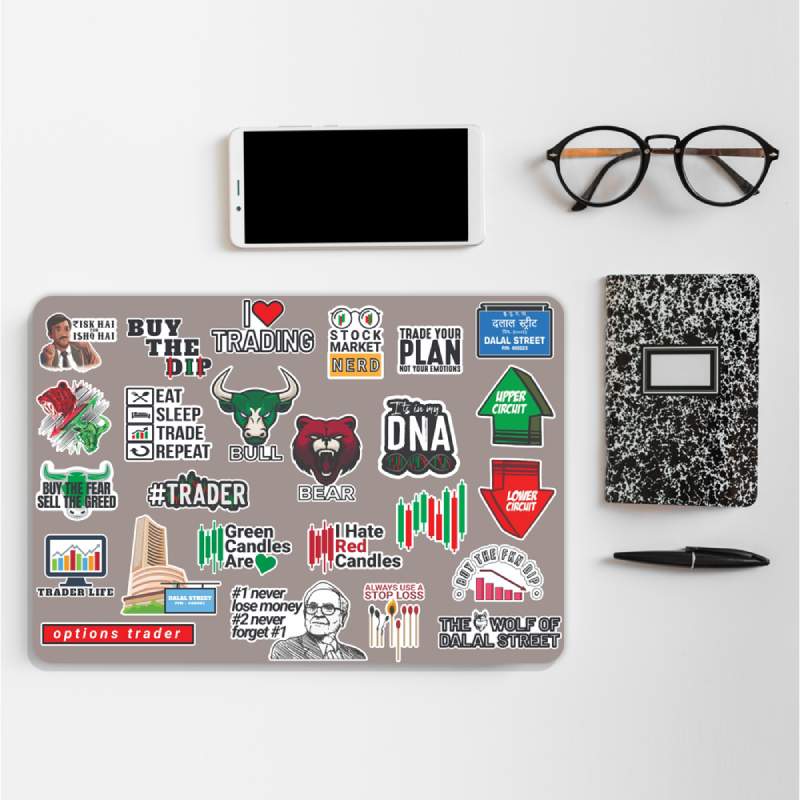

Circuit Limits for Individual Stocks and Index are different. The investors and traders think that circuit breakers i.e. stocks that hit upper circuit or lower circuit are best bets for them. It is not true. Upper Circuit is the limit above which a stock price cannot trade on a particular trading day. On the other hand, the lower circuit is the limit below which a stock price cannot trade on a particular trading day. These are also called circuit limits or circuit filter.In case of the upper circuit, there are only BUYERS in the stock and NO sellers. whereas in Lower Circuit, there are only Sellers and NO Buyers. . Stocks can have 2%,5%,10%,20% circuit limit and under any circumstances no stock is allowed to go beyond 20% higher or lower than yesterday’s closing priceexcept F&O stocks.

For example: If a company stock CMP is Rs.100.If it can move upward by 20% in a single trading day i.e 20% of 100 = 100+20 =120, so Rs.120 is upper circuit for it.

So if you place sell order above the upper circuit then your order will be rejected.

Note: There is NO circuit limit for stocks trading in derivatives segment i.e. Futures and Options segment. And the circuit limits are also not applicable on the date of the stock listing.

What is the reason behind placing circuit filter in Stock and Index?

The circuit limits for individual stocks and index are defined to control the volatility or extreme movements in the stock price or in the stock market index. The circuit limits are decreased to curb the volatility and the extreme price movements in the stock market. It is not possible to place any order in the stock till the stock price or index comes within the trading range.

Rules for Index Circuit Filter (Nifty/Sensex)

Rules for nifty/ Sensex are totally different and trading would stop immediately for 45 minutes if index rises or falls 10% and would reopen after 15 minutes ,Below is the table with details.

BY KAMAL KANOJIA ( https://twitter.com/KamalKnojia?s=08 )