“Nobody can predict weather, death, market, and women” -Rakesh Jhunjhunwala (1960-2022)

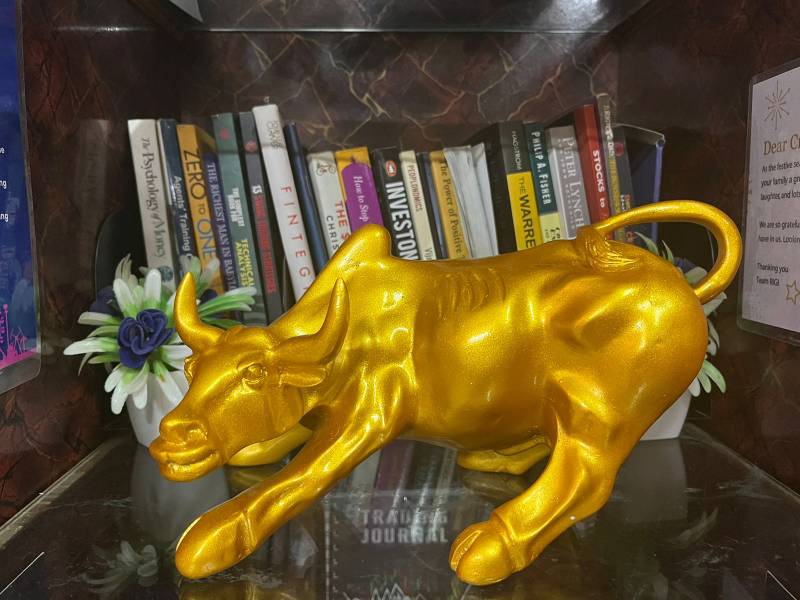

“Big Bull of Dalal street” and “King of Bull Market” Rakesh Jhunjhunwala, a visionary who served as an inspiration to many, a millionaire businessman and veteran investor, who made immeasurable contributions to the financial industry, passed away on Sunday morning, leaving the business world with a significant loss. The investing community is in shock following his passing. Over several decades, he dominated the Indian stock market by making wise investment decisions that allowed him to build a vast empire of stock holdings worth over 40,000 crores. He was a chartered accountant by profession, served as chairman of Hungama Media and Aptech, and served on the boards of several Indian businesses. Also serving on the boards of directors were Viceroy Hotels, Concord Biotech, Provogue India, and Geojit Financial Services, among others.

Mr. Jhunjhunwala, who is the son of an income tax official, first experimented with stocks while still a college student. Jhunjhunwala became interested in the stock market after hearing his father and his friends talk about it. The famous investor once recalled how his father had advised him to routinely read newspapers because the news was what caused the stock market to fluctuate.

Jhunjhunwala runs a privately-owned stock trading firm. The name of Jhunjhunwala’s privately held stock trading company, RARE Enterprises, is derived from the first two letters of his and his wife Rekha’s names. Jhunjhunwala has made investments over the years in a variety of companies, including Titan, CRISIL, Aurobindo Pharma, Praj Industries, NCC, Aptech Limited, Ion Exchange, MCX, Fortis Healthcare, Lupin, VIP Industries, Geojit Financial Services, Rallis India, and Jubilant Life Sciences. He won’t be around to witness the triumph of India’s most affordable airline, Akasa Air, which launched its first flight last week.

“Whatever you can do or dream you can begin it. boldness has genius power and magic in it”

Mr. Jhunjhunwala encouraged us to dream big and to never lose hope in India’s potential and its bright future. Those who spoke negatively about India would face his wrath. He was a great believer and storyteller of India. But most importantly, he was a great person. He wanted his friends and the general public to succeed financially, which was one of his best qualities. He wouldn’t think twice about stating his positions because of this. He always disclosed the stocks he purchased, the quantity, the cost, and the rationale for his decision. He was a generous man who insisted that charities receive between 25 and 30 percent of his income.

Let’s look at some of the important things Rakesh Jhunjhunwala has taught us about how to be successful investors.

“You cannot make profits in the stock market unless you have the ability to bear losses”

1. Invest in businesses which is hard to replace: –

“Invest in Companies which have strong management and competitive management”

Always seek companies who provide unique goods and services. Putting money into these companies will give you a competitive edge. He invests in companies with substantial moats. He thought that investing in these businesses gives investors a competitive advantage of their own.

2. Patience is a virtue: –

“When there are doom and gloom don’t forget there’s darkness before the dawn”

You must realize that investing is a long-term endeavour if you want to be a successful investor. You should be aware that it could take a decade or longer for your investments to start paying off. He claims that he invests in a company’s operations rather than its stock and that he doesn’t sell a stock, not even during market downturns. This does not imply that a stock should be purchased and held for seven years. It must be combined with diligence, knowledge of the company’s potential for growth, and future business prospects.

3. Be ready to grab an opportunity: –

“When opportunities come, they come through technology, marketing, brands, value protections, capital, etc. You need to be able to spot those”

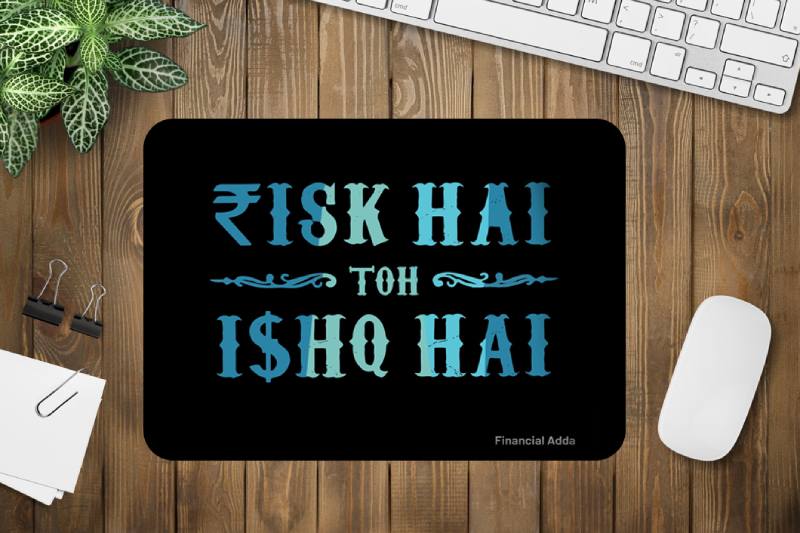

Rakesh Jhunjhunwala taught us that as investors, we must always be prepared to seize an opportunity. He is adamant that possibilities arise because of the market’s turbulence. He contends that having the capacity to take risks is essential for investors. Additionally, since the stock market is a nerve-wracking game, you cannot win money if you are frightened to lose it. Success in the stock market is more a function of your personality and character than of any other thing. He uses the 2008 financial crisis as an example when he bought stocks at a loss when the market thought they were undervalued.

4. Don’t rely on others to develop a passion for the stock market instead: –

“Anticipate trend and benefit from it. Traders should go against human nature”

Jhunjhunwala advises readers to conduct the study by reading and speaking with people who work in the investment industry if they wish to build a passion for learning about the stock market. If you depend on others for stock market advice or ideas, in his opinion, you will never discover a passion for studying. You should follow your gut and realize that there are no free lunches in the world of investment.

5. Avoid investing Money Impulsively: –

“Hastily taken decisions always result in heavy losses. Take your own time before investing in stocks”

When some people invest in stocks, those stocks increase in value. As a result, rather than acting rationally, he or she makes an impulse decision to invest in another one. One of the biggest mistakes anyone can make when investing is to invest emotionally. Jhunjhunwala thinks that when it comes to making investment decisions, investors should learn to suppress their emotions and act robotically. You must have confidence in the economic cycle and your investment philosophy if you want to be a consistent investor. To be a great investor, you must embrace some paradoxical habits and go against your instincts and impulses.

6. Never make investments at inflated prices: –

“Never invest unreasonable valuations. Never run for companies which are in limelight”

He asserts that it is always preferable to believe a company’s narrative when nobody else is. Regardless of the company’s current performance, if you think it has a lot of promise, you should strive to learn how it has done over the last two to three years and what its future prospects are. Do not worry too much about what other people think of this stock if you think they are good. Naturally, it’s critical to determine whether a company’s fundamentals are sound since while some companies appear to be undervalued, there may be a fundamental issue keeping them from rising in value.

7. Nothing Is Right or Wrong: –

“Respect the market, Have an open mind. Know when to take a loss. Be responsible”

Some investors believe that the most successful investors are also the best stock pickers. However, Jhunjhunwala will argue otherwise if you look at his track record. For instance, he invested in stocks like Bhushan Steel and Punj Lloyd in the late 1990s. He had made significant investments in companies like

NIIT and Mastek because he had high hopes for the IT industry. When the dot-com bubble burst in 2001–2002, all of these equities took a beating. Rakesh has been successful despite making mistakes so frequently because he has been able to recognize stocks that have 10 to 50 times more upside potential than their present prices. He has been able to multiply his returns by expanding his holdings in these stocks. By increasing his stake in Titan Industries from Rs 14 per share to Rs 2,000 per share, for instance, he amassed a fortune. His wagers on Aurobindo Pharma and Lupin Ltd. have also greatly profited. Even if you were the smartest person on the planet, you still wouldn’t be able to outperform the market. The Market, according to Jhunjhunwala, is above you. Market behaviour is sensible. The market is always going to be smarter than you. Although the market may first behave irrationally, it will eventually behave logically. Always be mindful of the market. Always assume it can do anything, even when you believe you understand it.

8. Although the past cannot be changed, it may be learned from. :-

“Whenever you regret making a mistake, you can use it as a learning opportunity to become a better investor and a better person.”

Rakesh Jhunjhunwala claims that investment has given him a wealth of life lessons. Every mistake you make in life, according to him, serves as a teaching opportunity. Rakesh Jhunjhunwala claims that despite the numerous mistakes he has made over his career, he would never admit that he regrets any of them since they have just strengthened his drive to put in more effort and seek out better investment opportunities. He claims that one lesson he’s gained from his blunders is that some industries are too competitive to be successful, and if the people behind those industries aren’t fully devoted, it’s a formula for disaster. I believe that everyone who invests should be grateful for their losses since they help us learn how to succeed in the future.

REST IN PEACE RAKESH JHUNJHUNWALA SIR

By Jaskirat Singh Gujral (Founder) & Anubhavi kishore (Content Writer)